02 cách tra cứu mã số thuế cá nhân, doanh nghiệp nhanh nhất

1. 02 cách tra cứu mã số thuế doanh nghiệp nhanh nhất

1.1. Tra cứu mã số thuế doanh nghiệp trên tiện ích tra cứu mã số thuế của THƯ VIỆN PHÁP LUẬT

Để tra cứu mã sô thuế doanh nghiệp trên tiện ích tra cứu mã số thuế của THƯ VIỆN PHÁP LUẬT cần thực hiện các bước như sau:

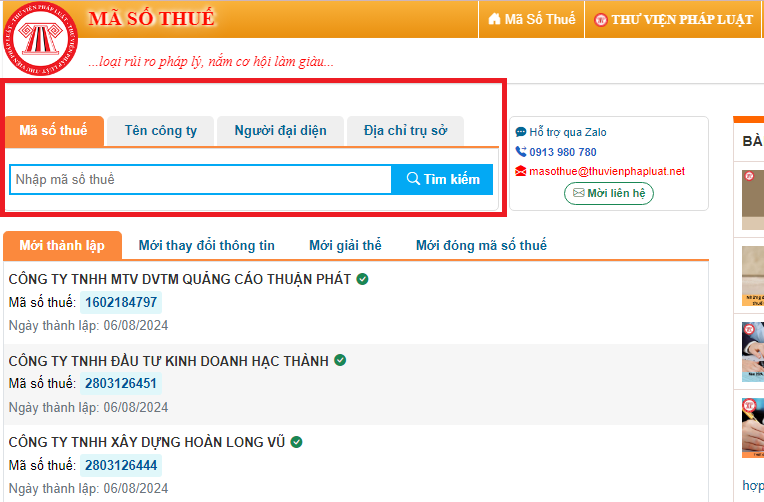

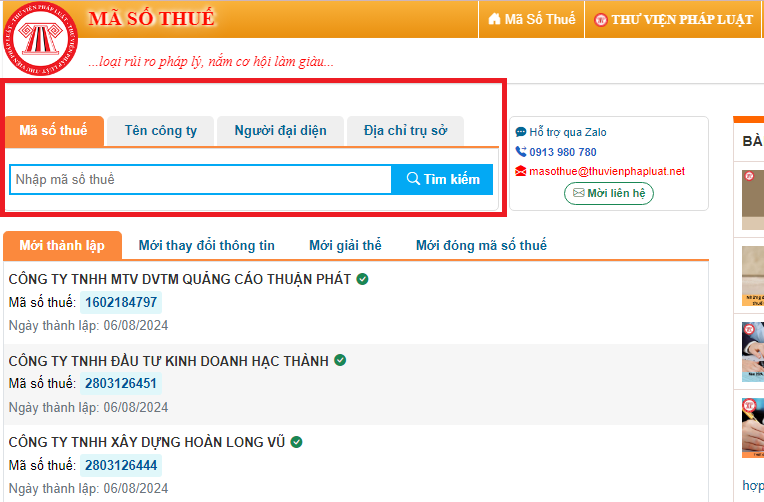

– Bước 1: Truy cập vào địa chỉ https://thuvienphapluat.vn/ma-so-thue

– Bước 2: Tại thanh tìm kiếm, tùy thuộc vào bạn nhớ được thông tin nào thì chọn 01 trong 04 tab là Mã số thuế, tên công ty, người đại diện, địa chỉ trụ sở để nhập thông tin.

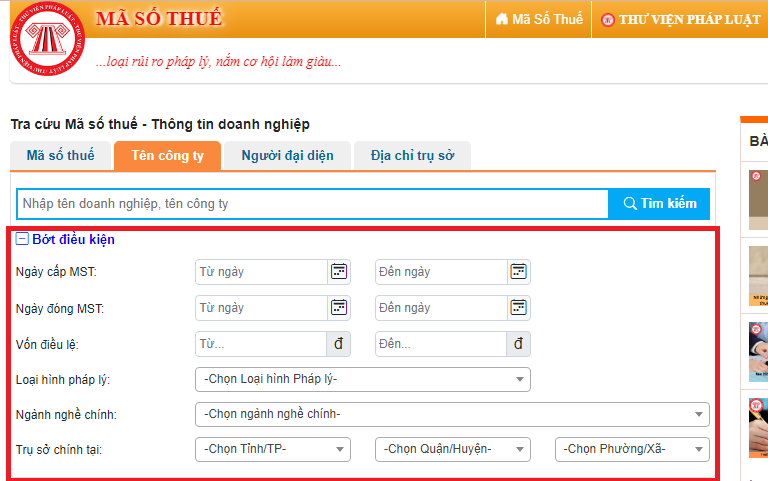

Ngoài ra, tại mỗi tab thì bạn có thể nhập thêm các điều kiện bên dưới để thu hẹp phạm vi tìm kiếm, giúp cho việc tìm kiếm được chính xác hơn.

Ví dụ: Bạn muốn tra cứu mã số thuế doanh nghiệp nhưng chỉ nhớ tên công ty thì bạn chọn tab “Tên công ty”. Sau đó nhập tên công ty mà bạn đang muốn tra cứu mã số thuế và bấm tìm kiếm.

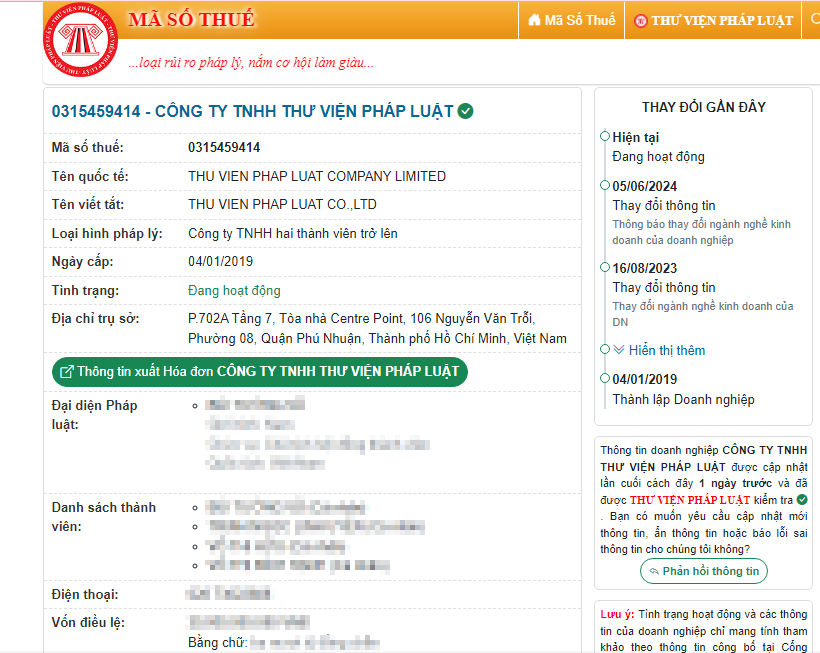

– Bước 3: Xem thông tin mã số thuế doanh nghiệp

Sau khi đã nhập thông tin tra cứu thì tiện ích sẽ cho ra kết quả tra cứu. Bấm vào kết quả thì tiện ích sẽ hiển thị các thông tin chi tiết của doanh nghiệp đó gồm:

– Mã số thuế.

– Tên quốc tế.

– Tên viết tắt.

– Loại hình pháp lý.

– Ngày cấp mã số thuế.

– Địa chỉ trụ sở.

– Đại diện Pháp luật.

– Vốn điều lệ.

– Ngành nghề kinh doanh,…

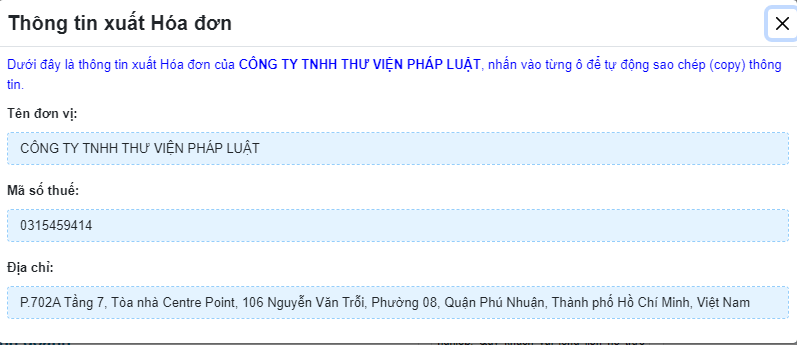

Đặc biệt, bạn còn có thể xem thông tin xuất hóa đơn của doanh nghiệp đó bằng cách chọn vào “Thông tin xuất hóa đơn…”. Đối với vấn đề xuất hóa đơn, thì Mã số thuế – THƯ VIỆN PHÁP LUẬT đảm bảo cho khách hàng 03 trường thông tin để đủ điều kiện xuất hóa đơn.

1.2. Tra cứu mã số thuế doanh nghiệp trên Tổng cục thuế

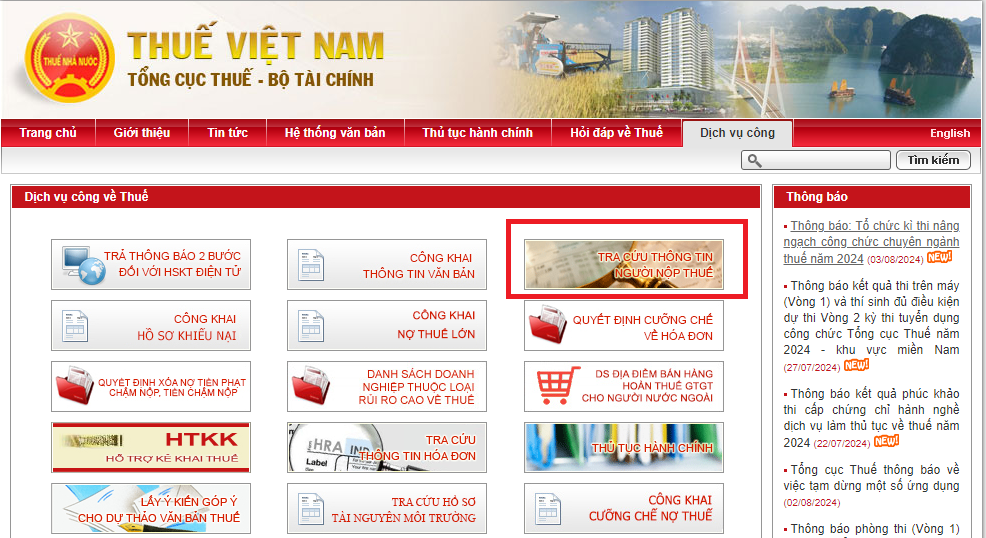

– Bước 1: Truy cập vào trang của Tổng cục Thuế tại địa chỉ https://www.gdt.gov.vn/wps/portal

– Bước 2: Chọn Dịch vụ công.

– Bước 3: Chọn Tra cứu thông tin người nộp thuế.

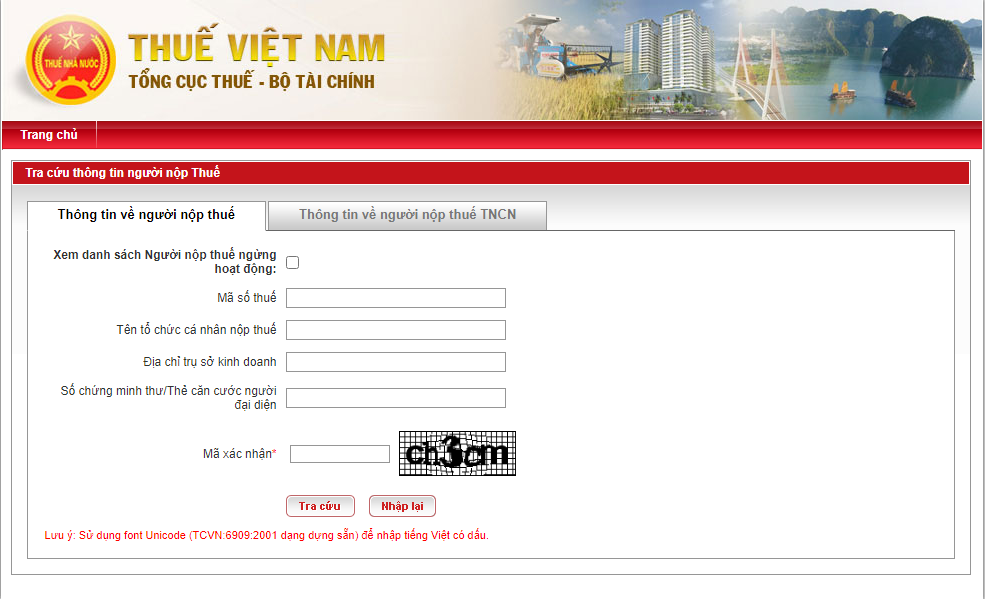

– Bước 4: Điền một trong ba thông tin sau:

+ Tên tổ chức cá nhân nộp thuế.

+ Địa chỉ trụ sở kinh doanh.

+ Số chứng minh thư/Thẻ căn cước người đại diện.

Sau đó nhập mã xác nhận và ấn tra cứu.

2. 02 cách tra cứu mã số thuế cá nhân nhanh nhất

Người nộp thuế có thể tra cứu mã số thuế cá nhân bằng 02 cách sau:

2.1. Tra cứu mã số thuê cá nhân trên trang Tổng cục thuế

Bước 1: Truy cập vào Trang thông tin của Tổng cục thuế tại địa chỉ http://tracuunnt.gdt.gov.vn/tcnnt/mstcn.jsp

Bước 2: Nhập số CMND/CCCD và mã xác nhận. Sau đó nhấn Tra cứu.

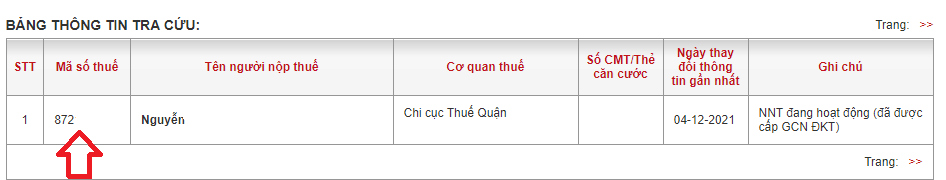

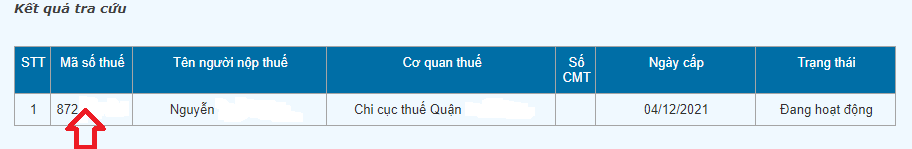

Bước 3: Xem mã số thuế cá nhân

2.2. Tra cứu mã số thuê cá nhân trên trang Thuế điện tử

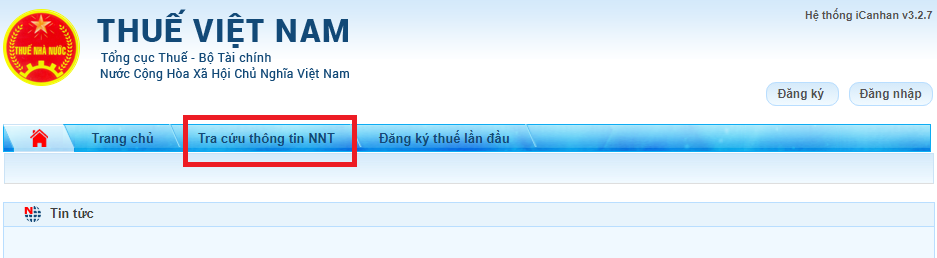

Bước 1: Truy cập vào Trang Thuế điện tử của Tổng cục Thuế tại địa chỉ https://thuedientu.gdt.gov.vn/

Bước 2: Chọn cá nhân

Bước 3: Chọn Tra cứu thông tin NNT

Bước 4: Nhập số CMND/CCCD và mã xác nhận. Sau đó nhấn Tra cứu.

Bước 5: Xem mã số thuế cá nhân.

3. Đối tượng đăng ký thuế và cấp mã số thuế

– Người nộp thuế phải thực hiện đăng ký thuế và được cơ quan thuế cấp mã số thuế trước khi bắt đầu hoạt động sản xuất, kinh doanh hoặc có phát sinh nghĩa vụ với ngân sách nhà nước. Đối tượng đăng ký thuế bao gồm:

+ Doanh nghiệp, tổ chức, cá nhân thực hiện đăng ký thuế theo cơ chế một cửa liên thông cùng với đăng ký doanh nghiệp, đăng ký hợp tác xã, đăng ký kinh doanh theo quy định của Luật Doanh nghiệp và quy định khác của pháp luật có liên quan;

+ Tổ chức, cá nhân không thuộc trường hợp quy định tại điểm a khoản này thực hiện đăng ký thuế trực tiếp với cơ quan thuế theo quy định của Bộ trưởng Bộ Tài chính.

– Cấu trúc mã số thuế được quy định như sau:

+ Mã số thuế 10 chữ số được sử dụng cho doanh nghiệp, tổ chức có tư cách pháp nhân; đại diện hộ gia đình, hộ kinh doanh và cá nhân khác;

+ Mã số thuế 13 chữ số và ký tự khác được sử dụng cho đơn vị phụ thuộc và các đối tượng khác;

– Việc cấp mã số thuế được quy định như sau:

+ Doanh nghiệp, tổ chức kinh tế, tổ chức khác được cấp 01 mã số thuế duy nhất để sử dụng trong suốt quá trình hoạt động từ khi đăng ký thuế cho đến khi chấm dứt hiệu lực mã số thuế.

Người nộp thuế có chi nhánh, văn phòng đại diện, đơn vị phụ thuộc trực tiếp thực hiện nghĩa vụ thuế thì được cấp mã số thuế phụ thuộc.

Trường hợp doanh nghiệp, tổ chức, chi nhánh, văn phòng đại diện, đơn vị phụ thuộc thực hiện đăng ký thuế theo cơ chế một cửa liên thông cùng với đăng ký doanh nghiệp, đăng ký hợp tác xã, đăng ký kinh doanh thì mã số ghi trên giấy chứng nhận đăng ký doanh nghiệp, giấy chứng nhận đăng ký hợp tác xã, giấy chứng nhận đăng ký kinh doanh đồng thời là mã số thuế;

+ Cá nhân được cấp 01 mã số thuế duy nhất để sử dụng trong suốt cuộc đời của cá nhân đó. Người phụ thuộc của cá nhân được cấp mã số thuế để giảm trừ gia cảnh cho người nộp thuế thu nhập cá nhân. Mã số thuế cấp cho người phụ thuộc đồng thời là mã số thuế của cá nhân khi người phụ thuộc phát sinh nghĩa vụ với ngân sách nhà nước;

+ Doanh nghiệp, tổ chức, cá nhân có trách nhiệm khấu trừ, nộp thuế thay được cấp mã số thuế nộp thay để thực hiện khai thuế, nộp thuế thay cho người nộp thuế;

+ Mã số thuế đã cấp không được sử dụng lại để cấp cho người nộp thuế khác;

+ Mã số thuế của doanh nghiệp, tổ chức kinh tế, tổ chức khác sau khi chuyển đổi loại hình, bán, tặng, cho, thừa kế được giữ nguyên;

+ Mã số thuế cấp cho hộ gia đình, hộ kinh doanh, cá nhân kinh doanh là mã số thuế cấp cho cá nhân người đại diện hộ gia đình, hộ kinh doanh, cá nhân kinh doanh.

– Đăng ký thuế bao gồm:

+ Đăng ký thuế lần đầu;

+ Thông báo thay đổi thông tin đăng ký thuế;

+ Thông báo khi tạm ngừng hoạt động, kinh doanh;

+ Chấm dứt hiệu lực mã số thuế;

+ Khôi phục mã số thuế.

(Điều 30 Luật Quản lý thuế 2019)

>>> Xem thêm Hướng dẫn 02 cách đăng ký mã số thuế cá nhân mới nhất

Nội dung nêu trên là phần giải đáp, tư vấn của chúng tôi dành cho khách hàng của

THƯ VIỆN PHÁP LUẬT.

Nếu quý khách còn vướng mắc, vui lòng gửi về Email [email protected].