Net fixed assets is a metric that evaluates the net value of a company’s fixed assets. It’s calculated by summing up the purchase price of all fixed assets and its additional improvements. Then, subtract the number with any accumulated depreciation. Basically, net fixed assets is a variable that tells you the real value of a company’s fixed assets.

This measurement is mostly useful for those who want to estimate the market value of a company’s fixed assets. Especially if they’re planning to acquire them. Knowing the net fixed assets, they can determine how much they would need to invest in the company’s fixed assets if they owned them.

The calculation is proven useful since knowing only the gross value of fixed assets doesn’t prove much utility for acquirers. For example, a company may have spent a big amount of cash to purchase fixed assets in the past. But if they don’t maintain them well, the real value of those assets is far lower over time.

The value of net fixed assets is expressed in the form of currency. However, you can take it a step further by expressing it as a ratio. You find the ratio by dividing the result of net fixed assets with the gross fixed assets.

To calculate net fixed assets, you will need to know the gross amount of fixed assets of the company. This refers to the purchase price of fixed assets when the company bought them plus improvements or additions to those assets to improve efficiency or effectiveness.

Fixed assets are long-term assets that can include buildings, lands, equipment, vehicles, and even software. Keep in mind that fixed assets are not “fixed” in a way that these assets only stays in one place (since vehicles are also included). They are “fixed” in a sense that they don’t often go in and out of the cash flows. Gross fixed assets are reported on the balance sheet as property, plant, and equipment (PP&E).

The next variables needed are accumulated depreciation and impairment—often grouped as contra assets. Accumulated depreciation can be thought of as the increasing depreciation of an asset up to some point during its operation.

The value of fixed assets continues to decrease regularly because of typical wear and tear, similar to goods people normally own. Meanwhile, impairment happens when the market value of an asset unusually drops for extraordinary reasons.

In terms of fixed assets, impairment commonly happens as a result of these assets being physically damaged. As a side note, the only fixed assets that doesn’t usually depreciate is land. The only exception to this is land with natural resources where the resources are being depleted.

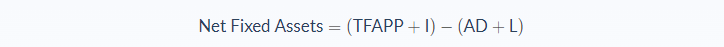

The net fixed assets formula above, however, still takes into account any possible liabilities lingering inside the fixed assets’ value. If you want to be even more specific, you can use this slightly modified formula instead to remove liabilities:

- TFAPP = total fixed asset purchase price

- I = capital improvements to the assets

- AD = accumulated depreciation

- L = fixed asset liabilities

This other formula gives you a more accurate value of net fixed assets since it eliminates any liabilities associated with it. Potential acquirers can have a more comprehensive understanding of how much the value out of the fixed assets that they will truly own.

Be aware, this formula is kind of tricky to calculate since liabilities associated with fixed assets are not explicitly mentioned on the balance sheet. Remember that we don’t take into account the total amount of non-current liabilities, only small parts of them that related to fixed assets. Because of this, you should use the first formula, which is more common.

Net Fixed Assets Example

ABC Company is looking to grow its business by merging itself with another company called XYZ Company. Before that, the company’s manager wants to know if XYZ Company is a good fit. To evaluate this, he or she uses the Net Fixed Assets calculation as one of the instruments to decide.

From the balance sheet, we can see the amount of property, plant, and equipment (PP&E) of XYZ Company to be $1,000,000. We can also observe that XYZ Company has accumulated depreciation of $125,000 and accumulated impairment of $25,000. Can you find the net fixed assets of the XYZ company based on this data?

Let’s break it down to identify the meaning and value of the different variables in this problem. Recall that property, plant, and equipment (PP&E) is equal to the gross fixed assets.

- Total assets: $1,000,000

- Accumulated depreciation/impairment: $125,000 + $25,000 = $150,000

Now let’s use our formula and apply the values to calculate net fixed assets:

In this case, the net fixed assets would be $850,000 or 85% of total fixed assets.

From the result above, we can see that XYZ Company is taking good care of its fixed assets and only lost 15% of its initial value. This also can be concluded from the relatively small impairment value it has. The assets have a small depreciation, 12.5% of gross fixed assets. This can further tell that the assets are not old and can be potentially used for a couple of years before needing replacements.

Net Fixed Assets Analysis

Knowing the net fixed assets of a company is very important for potential acquirers. The higher the net fixed assets ratio compared to the total fixed assets, the better it will be for them. A high net fixed assets are ideal so that they don’t have to replace most of the property and equipment should they own them later.

Keep in mind, however, that the net fixed assets value is not effectively the fixed assets value in the market. Each business uses different methods to depreciates its assets and it might not reflect the price at which those assets could sell. Analysts need to know which accepted method the company uses to ascertain how the values were determined.

There is also a possible case that a certain fixed asset is depreciated or impaired so much that it has a net book value of zero, meaning it possibly can’t even be sold. The asset is not necessarily in a broken state. Accelerated depreciation—a greater value reduction in the asset early years—may play a big part in it, even though the asset is still effectively usable.

These kinds of fixed assets are not recorded on the balance sheet. This gives analysts the wrong impression of how much depreciation and impairment the fixed assets have. Analysts should keep in mind this possibility as companies may use the accelerated depreciation strategy for taxation purposes.

Net Fixed Assets Conclusion

- The net fixed assets is the net value of a company’s fixed assets.

- The formula for net fixed assets requires three variables: total fixed assets, accumulated depreciation, and accumulated impairment.

- To exclude liabilities, simply subtract the value of net fixed assets with any liabilities related to it.

- Net fixed assets is not the same as the asset market value since any depreciation is only the company’s interpretation of the asset’s value.

- Certain fixed assets may have the book value of zero and not recorded on the balance sheet, leading to wrong analysis.

Net Fixed Assets Calculator

You can use the net fixed assets calculator below to quickly calculate the net value of a company’s fixed assets by entering the required numbers.

FAQs

1. What is a Net Fixed Asset?

A Net Fixed Asset is the total value of a company’s fixed assets reduced by its accumulated depreciation and any impairment it has. Any pending liabilities are also deducted from the calculation.

2. How do you calculate Net Fixed Assets?

A company’s Net Fixed Assets are equal to its total fixed assets minus its accumulated depreciation. It can also be represented in a formula:Net Fixed Assets = Total Fixed Assets − Accumulated Depreciation

3. What are Net Fixed Assets on the balance sheet?

In the balance sheet, Net Fixed Assets are equal to the book value of a company’s fixed assets less its accumulated depreciation. This is the figure that must be used when calculating Net Fixed Assets.

4. What are the examples of fixed assets?

Fixed assets are recorded on the balance sheet. This includes property, plant and equipment, land, intangible assets, investment properties, and other long-term tangible investments.

5. Does Net Fixed Assets include current assets?

No. Net Fixed Assets are the net value of a company’s fixed assets alone and do not include any of its current or non-current assets.